- Krushi is working in collaboration with CARE since 2002 on MF strategy

- CASHE Project – to enlarge livelihood opportunities for rural households through micro finance initiative

- INHP Project – to reduce IMR, MMR and malnutrition by improving Health and Nutritional status of vulnerable women and children

Vision

Poverty reduction through promotion of sustainable community managed, owned and controlled financial institutions and in the process Krushi to emerge as a professional micro finance institution.

Mission

To create community managed sustainable micro finance institutions, which provide efficient services and lead towards augmenting productive occupations, there by making a significant impact on poverty.

Core Areas of MF Program

- Institutional development

- Credit support services

- Promotion of livelihood initiatives

- Address gender issues

Operational Area of CASHE Project

Mandal |

MACS |

No. of Villages |

No. of SHG's |

No. of Members |

Siricilla |

Siricilla Rural (Padmanagar) |

11 |

89 |

1175 |

|

Jillella |

5 |

75 |

1022 |

|

Siricilla Urban |

7 |

112 |

1820 |

Ellanthakunta |

Ellanthakunta |

16 |

165 |

2278 |

|

Repaka |

5 |

65 |

945 |

|

Pedda Lingapur |

5 |

56 |

780 |

Yellareddypet |

Veernapally |

7 |

62 |

792 |

|

Yellareddypet |

7 |

97 |

1353 |

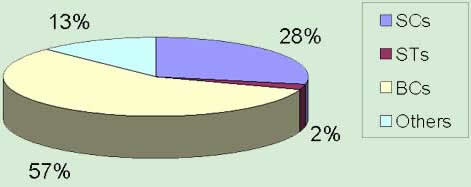

Most of the SHG women are from SC, ST, backward classes and other economic backward classes

Social Profile Of Members

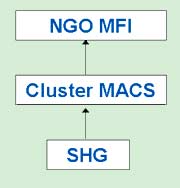

Program Structure

|

(MFI in collaboration with professionals) |

| Its mission is to provide an effective credit plus activities to SHG's for improve the living standards of the poor. |

| To improve the socio economic conditions of the poor women through thrift & credit activity |

Products and Services

A . Savings

| TERMS |

MACS- GROUP SAVINGS |

| AMOUNT PER GROUP for 10 members |

Rs. 300 to 500 |

| PERIODICITY |

MONTHLY |

| INTEREST ON SAVINGS |

5% P.A. |

| WITHDRAWAL |

NO WITHDRAWALS |

Products and Services

B. Loans

| TERMS |

PRODUCT 1 – INCOME GENERATION LOAN |

| Amount of Loan |

Rs.5,000 to Rs. 10,000 |

| Purpose |

Income Generation-Agriculture, Enterprises and trading Animal Husbandry, etc. |

| INTEREST Rate |

18% per annul (declining) |

| Repayment period |

12 to 18 Months |

| Security |

No Collateral Security |

Products and Services

C. INSURANCE

| Name of the Organization |

No. of Clients Covered |

| Royal Sundaram |

3000 |

| JBY |

800 |

| SBI Life |

2500 |

Loan Processing

Initially at the group level the members conduct the demand assessment and submit to the group leaders in the meetings. Then the applications are scrutinized in the meetings and after approval by majority members it is recommended to the MACS.

At the MACS level, the applications are thoroughly examined in the board meetings and by approval of the MACS board, it will be submitted to either banks or MFIs through NGO concerned. After getting the loan from the financial institutions the same will be dispersed to the SHG's.

Documentation

The documentation will be made at two levels i.e., SHG level and MACs level. The following systems are adopted for documentation.

At SHG level

- Application from the member to SHG

- Approval of the loan application by SHG

- Submission of promissory note by the applicant to SHG includes two guarantors signatures

- Disbursement of loan to the applicant by SHG

Documentation

The documentation will be made at two levels i.e., SHG level and MACs level. The following systems are adopted for documentation.

At SHG level

- Application from the member to SHG

- Approval of the loan application by SHG

- Submission of promissory note by the applicant to SHG includes two guarantors signatures

- Disbursement of loan to the applicant by SHG

Recovery Mechanism

The group will communicate the repayment schedule while dispersing the loan amount to the members. According to the schedule the member will repay the loan amount including interest in installment basis as per the agreement.

Similarly, the MACS will circulate the repayment schedule to the SHG’s while on lending the RLF to the members through SHG’s. As per the repayment schedule, the SHG’s will repay the loan amount with interest in installments to MACS every month by collecting the loan amount from the members.

However the ways for recovery of loans in case of default at group level are shown below.

- Member savings

- Savings of the guarantors

- In case the loan amount exceeds the savings amount will be recovered as per the decision of the group members.

Recovery Mechanism

The following are the means for recovery of loans in case of default at MACS level.

- Savings of the group

- Repayments of the saving loan amount

- Savings of the groups stood as guarantors

In recovery process, various stake holders will be held responsible i.e members, SHG leaders, VO board members, MACS board members. Thus, in this project, with the support of strong network, i.e member to MACS board level will be shared their contribution towards avoid the delinquency at every step.

|